non filing of income tax return notice under which section

Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such. People missing out on their due date for filing returns have to use this section for filing their ITRs.

What To Do If You Receive A Missing Tax Return Notice From The Irs

File your ITR as soon as possible and attach the ITR-V or reply with Return under preparation.

. This article focuses on such cases wherein you may receive a notice for non-filing of ITR. In the absence of any records and evidences we are not in a position to adjudicate this case. If the 4506-T information is successfully validated tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10 days.

Furnish the appropriate reasons for not filling the Income Tax Returns. Jewelry is valued at the market price whereas the valuation of the second house is. The first home that individual holds is exempted from any tax.

Submit the letter to the financial aid office. An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax. Pay taxes online as you pay for self assessment taxes.

25 lakh as per the prevailing tax rules. The proviso to Section 276-CC gives some relief to genuine assessees. Under the compliance tab click on View and Submit my Compliance option.

Notice for Non-Disclosure of Income. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. For filing the wealth tax valuation of the property needs to be done and for this help can be taken from government approved valuers.

The proviso to Section 276-CC gives further time. You get a defective return notice under section 1399 of the Income Tax Act. Once received you need to respond to it within 15 days from the date of receiving the notice.

Go to e-file dropdown and select e-file response us 139 9. Browse XML generated in the response. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

Click on e-file in response to notice us 139 9. A Re-assessment proceeding also referred as re-opening of the assessment is initiated by the. When a notice under section 148 is received the assessee is asked to file a return of the relevant assessment year.

All groups and messages. Fill the reference acknowledgment number and fill the form with the correction. Section 139 1 is a vital component of the ITR.

Then select the option section 139 9 where there has been a mistake in the return filing. The assessee need to address the tax notice and reply accordingly within specified time limits. In case of non-filing of return a notice under section 1421 is issued mentioning to file the return.

Then login to the income tax portal. IRC 6651 a 1 imposes a penalty for failure to file a tax return by the date prescribed including extensions unless it is shown that the failure is due to reasonable cause and not due to willful neglect. The issue of a notice under section 148 of the Income-tax Act the Act calling upon the Taxpayer to file a return of income for the year specified in the notice is the starting point of the Re-assessment Re-audit proceedings.

To pay the remaining income tax us 139 9 of the Income Tax Act 1961. Notice for Non-Payment of Self Assessment Tax. Income Tax Notice are in the form if intimation under section 1431 or proper Income Tax notice under section 1432 1421 148 or 245.

See IRM 20123 Failure to File a Tax Return -. File your revised return and generate XML for the same. For filing defective return If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department.

Filing income tax returns is mandatory if your annual income surpasses Rs. After filing the return the assessee must ask for a copy of reasons recorded for issuing of a notice under section 148 after which they are permitted to file an objection to the issuance of notice. You may still receive a notice for non filing of ITR even if you were not required to file your ITR.

Further the penalty orders clearly states that the assessee did not file the return of income in response to the notice issued under section 148 of. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the assessee under Section 142 or Section 148 of the Act. If you have not filed the Income Tax Return by July 31 you will get a notice on non-filing of ITR.

Terms and conditions may vary and are subject to change without notice. For the amount above Rs30 Lakh tax is levied at the rate of 1. Upon successfully log in to the account click on the Compliance Tab.

Here are some of the main provisions covered under the Income Tax Acts. You could get this notice within a year of the end of the assessment year for which return has not been filed. Under this section details of non-filing of Income tax returns will be furnished.

Mail or Fax the Completed IRS Form 4506-T to the address or FAX number provided on page 2 of form 4506-T.

What Is A Cp05 Letter From The Irs And What Should I Do

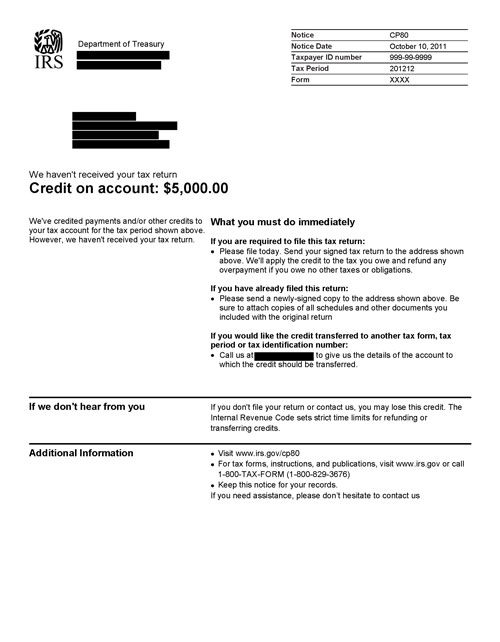

Irs Notice Cp80 What You Must Do

Letter Format To Income Tax Department For Demand Notice Income Tax Letter Template Word Income

Things You Didn T Know About Filing Income Tax Return Income Tax Return File Income Tax Tax Return

Non Filing Of Income Tax Returns Despite Earning Taxable Salary Kindly Refer To The Subject Noted Above 2 Section 1 Income Tax Return Income Tax Tax Return

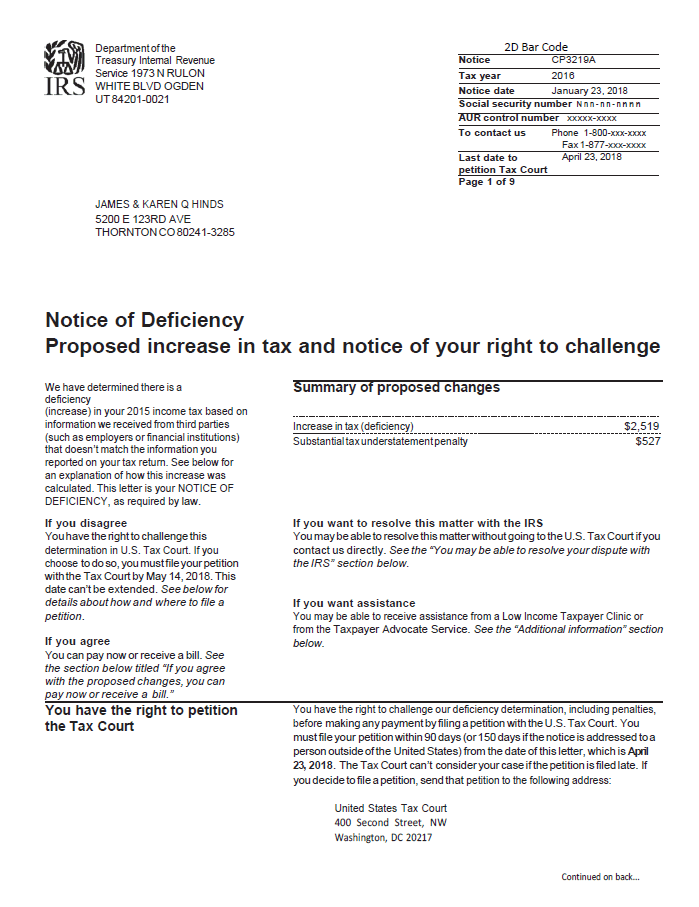

Notice Of Deficiency Overview Irs Forms Options

The Times Group Tax Return Income Tax Income Tax Return

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Business News Today Read Latest Business News India Business News Live Share Market Economy News The Economic Times Income Tax Notice Meaning Income

What Is A Cp05 Letter From The Irs And What Should I Do

Income Tax Filing India Itr Filing Taxation Policy In India Income Tax Filing Taxes Income Tax Return

Filing Of Audited Or Un Audited Accounts As Well As Tax Planning Is Very Important The Inland Revenue A Filing Taxes Tax Filing Deadline Financial Statement

Accounting Taxation Ignore Income Tax Notices With Simple Tips Income Tax Income Tax Return Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/7IV55M2OM5ADNKKQ6YIU4DTFA4.png)

Received A Confusing Tax Letter Here S What Experts Say You Should Do

Receiving An E Mail Intimation Or Notice From The I T Dept Is A Scary Proposition For All Of Us However These Intim Financial Advice Income Tax Return Taxact

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

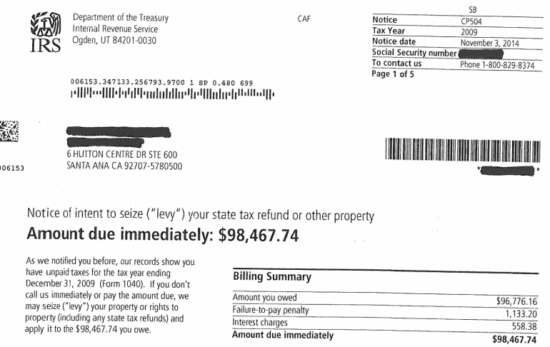

Irs Tax Notices Explained Landmark Tax Group

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 Profe In 2022 Letter Templates Lettering Name Tag Templates

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax